When individuals begin to learn of the many advantages of offshore or international banking, it is natural to want to establish a personal account and begin reaping the benefits. However, the wide range of account types can sometimes be overwhelming, leading people to select accounts that aren’t suited to their lifestyles or their financial needs. Often, a demand deposit account is the perfect fit.

A deposit account for the purpose of securely and quickly providing frequent access to funds on demand, through various different channels. Because money is available on demand, these accounts are also referred to as 'demand accounts' or ' demand deposit accounts', except in the case of NOW (negotiable order of withdrawal) accounts, which are. The Flexi Fixed Deposit feature gives you the liquidity of a Current Account coupled with high earnings of a Fixed Deposit. This is achieved by creating a Fixed Deposit (FD) linked to your Current Account providing you the unique facilities. Features of Flexi Fixed Deposit. Minimum balance in the Current Account should be Rs 1,05,000 to. May 03, 2018 The security deposit demand letter is a request that is made by a tenant reminding the landlord to repay the funds that were paid at the beginning of the lease term. Typically, this letter is written after the landlord has not paid the tenant back within the State required time-frame, which ranges from 14 to. USD: 4,080arrowdropdown: 4,093arrowdropdown: EXCHANGE RATE. THB: 133.00arrowdropdown: 134.70arrowdropup.

To determine this for yourself, learn more about what a demand deposit account is, how it can be used and how it has the potential to benefit account holders.

What is a Demand Deposit Account?

In the most basic definition, a demand deposit account is just as the name suggests: An account where you can demand to withdraw any amount instantly. In a lot of ways, a demand deposit account is just like a checking account. You deposit money into the account periodically, and then you withdraw amounts when you need access to it.

However, there are some variations differentiating a demand deposit account from a checking account. To start, both accounts may have limitation on how quickly money can be withdrawn. When you write a check, for example, it could take a few business days to clear.

Another name for a demand deposit account is a NOW account, which speaks to the immediate nature and urgency of this particular type of banking account.

Demand Deposit Account Definition

How To Use a Demand Deposit Account

A demand deposit account works as a vehicle for your deposits. These deposits can be automatic transfers from your place of work, or they could be checks from employers, vendors or family members. Whether the deposit is physical cash, a check or an electronic transfer, the money will go straight to the balance of your demand deposit account. Similarly, you can access the balance in a number of ways. If the account is connected to a debit or credit card, you can shop and spend as normal.

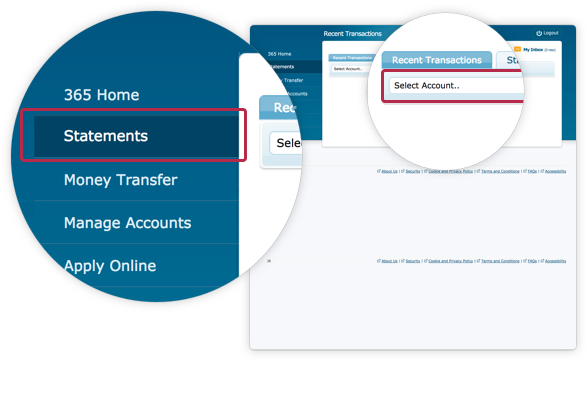

Alternatively, you can write and cash checks, pay bills online or make online transfers. Clearly, having online banking services in conjunction with a demand deposit account will increase its value and utility in a number of ways.

Benefits of a Demand Deposit Account

The primary benefit of a demand deposit account is that your assets held within it are available on demand. There is typically no waiting period to access your money, or the waiting period is very short and just a couple of days.

Having immediate access to your liquid assets can give you peace of mind that if you ever need money, it is ready and available for you at a moment’s notice.

Ideal Candidates for a Demand Deposit Account

So many different types of people can benefit from a demand deposit account. If you ever write checks, or you’re just beginning to explore the potential of diversification with an offshore bank account, then a demand deposit account is ideal.

If you travel abroad often, or you’re planning to buy a second home overseas, then a demand deposit account can come in handy more than any other banking option.

Once you learn more about the demand deposit account, it becomes obvious that it is a smart, popular choice for investors, retirees and small business owners around the world.

Contact us at Caye Bank today and let us help with your financial needs.

Related posts:

Demand deposits or non-confidential money are funds held in demand accounts in commercial banks.[1] These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country.[2] Simply put, these are deposits in the bank that can be withdrawn on demand, without any prior notice.

History[edit]

Demand Deposit Account Meaning

In the United States, demand deposits arose following the 1865 tax of 10% on the issuance of state bank notes; see history of banking in the USA.

In the U.S., demand deposits only refer to funds held in checking accounts (or cheque offering accounts) other than NOW accounts; however, in a 1970s and 1980s response to the 1933 promulgation of Regulation Q in the U.S., demand deposits in some cases came to allow easier access to funds from other types of accounts (e.g. savings accounts and money market accounts). For the historical basis of the distinction between demand deposits and NOW accounts in the U.S., see Negotiable order of withdrawal account#History.

Money supply[edit]

Demand deposits are usually considered part of the narrowly defined money supply, as they can be used, via checks and drafts, as a means of payment for goods and services and to settle debts. The money supply of a country is usually defined to consist of currency plus demand deposits. In most countries, demand deposits account for a majority of the money supply.[2]

During times of financial crisis, bank customers will withdraw their funds in cash, leading to a drop in demand deposits and a shrinking of the money supply. Economists have speculated that this effect contributed to the severity of the Great Depression.[3]

This did not happen, however, in the financial crisis that began in 2008. In fact, demand deposits in the U.S. increased dramatically, from around $310bn in August 2008 to a peak of around $460bn in December 2008.[4]

See also[edit]

References[edit]

- ^'Bank Money: Merriam-Webster Dictionary'. www.merriam-webster.com. Retrieved 19 August 2009.

- ^ abKrugman, Paul R., and Robin Wells. Economics. New York: Worth, 2006. Print.

- ^Friedman, Milton (1 November 1971). Monetary History of the United States, 1867-1960. Princeton University Press. ISBN0-691-00354-8.

- ^'Federal Reserve Bank statistics'. www.federalreserve.gov. Retrieved 18 March 2010.